New Delhi, 10 August: On Thursday, the Reserve Bank of India (RBI) will announce its bi-monthly monetary policy for fiscal year 2024.

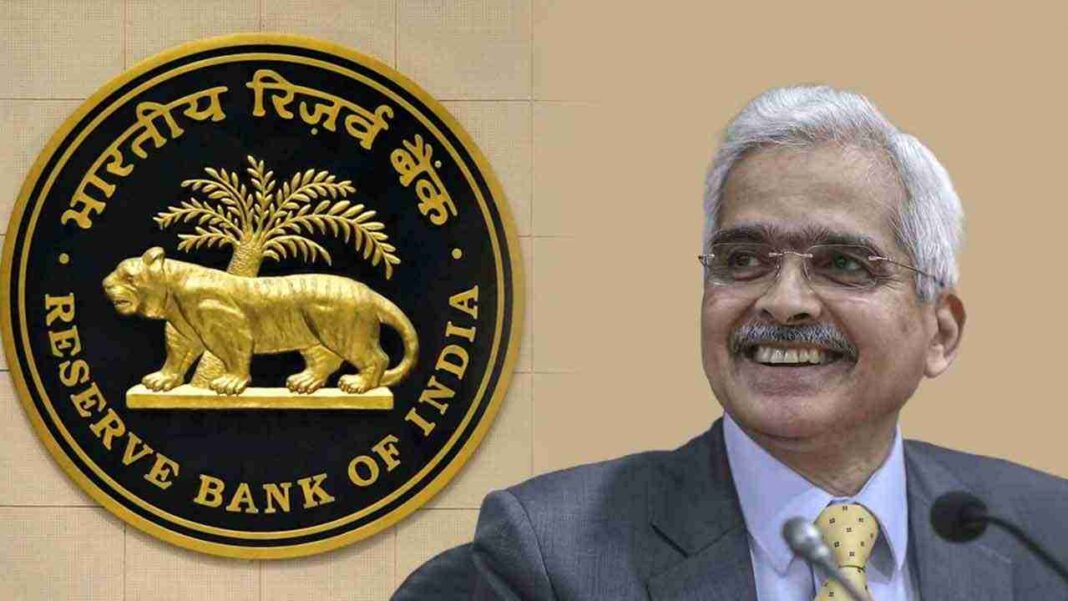

On Thursday, August 10, at 10:00 a.m., RBI Governor Shaktikanta Das will formally announce the Monetary Policy Committee’s (MPC) decision.

Economists, investors, and financial markets have been paying close attention to the ongoing Monetary Policy Committee meeting, which began on August 8. They are looking forward to the central bank’s instructions on India’s economic trajectory. This meeting is extremely important in the context of the country’s and the world’s changing economic landscapes.

In the wake of global uncertainties and upheavals, the RBI’s monetary policy stance has significant weight over India’s economic recovery, inflation dynamics, and overall financial stability.

Market professionals and analysts are keeping a close eye on numerous factors that could affect the RBI’s next decision. These include patterns in inflation, the rate of economic growth, global market volatility, and potential policy adjustments to handle emerging difficulties.

RBI maintains unchanged repo rate in third consecutive policy meeting

Mumbai, 10 August: During its three-day monetary policy committee meeting, the Reserve Bank of India (RBI) announced its decision to keep the repo rate at 6.5 percent, in line with most financial markets’ forecasts. During a news conference on Thursday, RBI Governor Shaktikanta Das remarked, “The Monetary Policy Committee unanimously decided to keep the Repo Rate unchanged at 6.50%.”

Traditionally, the RBI meets six times a year to determine interest rates, money supply, inflation projections, and other macroeconomic variables. The three-day meeting, which began on Tuesday, is the third session of the 2023-24 era. The central bank’s monetary policy committee unanimously decided to keep the repo rate at 6.5 percent in its previous meeting in early June, consistent with most analysts’ expectations. The RBI had similarly halted the repo rate during its April meeting. The repo rate is the interest rate at which the Reserve Bank of India loans to other banks.